Last month Wall Street Journal reporting that Microsoft was apparantly trying to buy 5% of Facebook for $300 – $500 million. Today the NY Post is reporting that Google is trying beat Microsoft to the punch trying to bid for 5 – 10% of Facebook Inc. It is expected that the deal will be announced within the next 48 hours and Facebook’s investors are looking for a pre-money valuation of $10 billion-$15 billion in any deal. On the high side, that means Microsoft or Google would have to come up with $1.5 billion for a 10 percent stake or $750 million for a 5 percent piece.

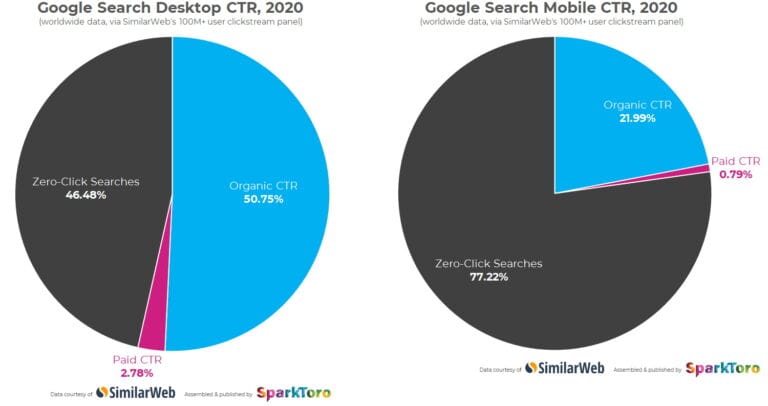

The main reason for both Google and Microsoft wanting a stake in Facebook is to ensure they secure the advertising deal for the site. While I think it is great that the Social Boom is making so many people rich my main concern is the fact that everything relies on Advertising to make a profit. Now this advertising maybe more targetted than the likes of TV etc but more and more people are using browsers such as Firefox (Sept 06 Firefox useage was 27.3% Sept 07 was 35.4%) with many of these users chosing to install extentions such as Adblock Plus (300,000 new users a month ). Using Firefox with Adblock Plus almost completely eliminates advertising, infact the only adverts I ever see are the Sponsored Links in Google. As the popularity of Firefox/Adblock increases then surely advertising revenue is going to be severly reduced? Even worse if these become mainstream will there be a Dot Com style crash?